Commercial Banking

- Home

- |

- Business Banking

- |

- Commercial Banking

The Commercial Banking Division provides specialised financial services to small businesses and multinationals to support operations in developing and developed markets. From creating access to a wide range of capital financing to the ease of mobile banking, we provide the resources required for this customer segment between the Retail and Corporate ends of the market.

Our Service Promise

We support, guide and grow customers by providing the necessary financial solutions for sustainable growth, investment, profitability and liquidity management.

Our Delivery Model

Our financial and business experts have the products, experience and knowledge to work with your firm to tailor financial solutions that help meet your set goals. Our passion is to grow small and medium businesses into conglomerates. We take the burden of selecting financial options off you so you can concentrate on building your business.

Corporate Current Account

This is a current account designed for registered business

Features

▼

- Minimum opening balance of N10,000

- No minimum operating balance

- N1 per mille monthly CAMF fees

- Issuance of cheque books (valid for clearing)

- Account can be used to access loans

- No limit to number of withdrawals

Requierments

▼

- Duly filled and signed account opening form

- BVN from signatories

- Documentary evidence of address for the company e.g utility bill

- 2 references (corporate entities only)

- 2 passport photographs

- Valid means of identification of each signatory

- Residence Permit (where applicable)

- Certificate of Incorporation / Business Registration

- Forms CO7 and CO2

- Memorandum and Articles of Association

- Board resolution

- Tax Identification Number

- SCUML certificate (DNFBPs only)

GrowBiz Account

The Keystone Growbiz account is designed to meet the needs

Features

▼

|

S/N |

FEATURES |

GROWBIZ CLASSIC |

GROWBIZ GOLD |

|

1 |

Opening balance |

SME/Traders – N/A Corporates – N/A |

SME/Traders – N50,000 Corporates – N250,000 |

|

2 |

Minimum balance |

SME/Traders – N/A Corporates – N/A |

SME/Traders – N50,000 Corporates – N250,000 |

|

3 |

Monthly maintenance fee |

SME/Traders – 1,700 Corporates – 2,500 |

SME/Traders – N/A Corporates – N/A |

|

4 |

International banking services |

Access to international banking services |

Access to international banking services |

|

5 |

Cheque Book |

Access to cheque book duly paid for. |

Access to cheque book duly paid for. |

|

6 |

Credit Facilities |

Access to Credit Facilities (Terms and Conditions apply) |

Access to Credit Facilities (Terms and Conditions apply) |

|

7 |

Advisory Services |

Financial advisory service for business clusters |

Financial advisory service for business clusters |

Online marketplace to be delisted for now until the service is restored.

Requirements

▼

| Individual | Micro, Small and Medium Enterprises and trader | Corporate |

|---|---|---|

| Duly filled and signed account opening form | Duly filled and signed account opening form | Duly filled and signed account opening form |

| Valid means of identification | Certificate of Registration | BVN from signatories |

2 references (current account holders only) | Form of application for registration of business name | Documentary evidence of address for the company e.g utility bill |

| Documentary evidence of address | Documentary evidence of address for the business | 2 references (corporate entities only) |

| BVN from customer | 2 confirmed references | 2 Passport photographs |

| Passport photograph of the signatory | Passport photograph of each signatory | Valid means of identification of each signatory |

| Mandate card | Mandate card | Residence Permit (where applicable) |

| Copy of valid ID of the signatory | Copy of Valid means of identification of the signatory | Certificate of Incorporation / Business Registration |

| Tax Identification Number | Forms CO7 and CO2 | |

| BVN from customer | Memorandum and Article of Association | |

| SCUML certificate (DNFBPs only) | Board resolution | |

| Tax Identification Number | ||

| SCUML certificate (DNFBPs only) |

Domiciliary Account

Keystone Bank Domiciliary Account is a current account

Features

▼

- Account can be denominated in Dollars, Pounds or Euros

- Minimum opening balance of 100 Dollars, 100 Euros or 100 Pounds

- Zero minimum operating balance

- Competitive interest rates

- Issuance of cheque book (not valid for clearing)

- No maintenance fee

- No limit to number of withdrawals

- Access to Keystone Bank debit/credit card.

- Access to safe and secure E-Banking services & Channels - Mobile Banking and Internet Banking services

Requirements

▼

- Duly filled and signed account opening form

- Valid means of identification

- Documentary evidence of address

- 2 references

- BVN

- Passport photograph

- Mandate card

Dom Extra Account

Keystone Bank Domiciliary Extra Account is a foreign

Features

▼

- Account can be denominated in Dollars, Pounds or Euros

- Minimum operating balance of 1,000 USD, 1,000 GBP or 1,000 EUR

- Issuance of personalized chequebooks (not valid for clearing)

- Zero transfer charge

- Competitive interest rates.

Access to Keystone Bank debit/credit card. - Access to safe and secure E-Banking services & Channels - Mobile Banking and Internet Banking service.

Requirements

▼

- Duly filled and signed account opening form

- Valid means of identification

- Documentary evidence of address

- 2 references

- BVN

- Passport photograph

- Mandate card

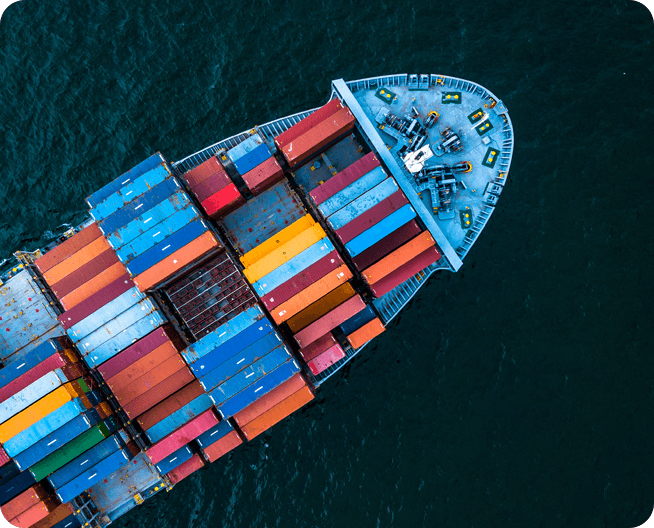

Trade Finance

We Deliver Customer-focused Trade Finance Solutions. At

Differentiation of Trade Instruments

▼

Trade Products

- Bank Guarantee (BG)

- Documentary Letter of Credit (LC)

- Standby Letter of Credit (SBLC)

- Documentary Collections.

- Trade Advisory Services and Intermediations.

- Global Coverage

- Export Receivable Discounting Facility-ERDF

- Import Finance Facility-IFF

Keystone Bank maintains a global footprint through a strong correspondent banking network and key strategic alliances with multilateral agencies and development finance institutions.